How Does Bad Cashflow Influence Profit Sharing in Mudharabah?

Mudharabah contracts represent a crucial aspect of Islamic finance, providing a partnership where one party supplies the capital and the other provides expertise and management. Howver, According to pre-determined ratios, the venture’s profits are divided, but the capital provider is responsible for losses. Understanding how a company’s cash flow influences profit sharing in Mudharabah contracts is essential for both parties involved.

Understanding Company Cash Flow

Cash flow refers to the net amount of cash being transferred into and out of a business. It consists of three main components: operating cash flow, investing cash flow, and financing cash flow. Effective management of cash flow ensures that a company can meet its obligations, invest in opportunities, and distribute profits.

Operating cash flow is derived from the core business activities, indicating the efficiency of the business in generating cash. Investing cash flow represents cash used or generated from investments in assets. Financing cash flow includes cash transactions related to debt, equity, and dividends. A healthy cash flow ensures that a business can sustain operations, grow, and provide returns to investors.

The Relationship Between Cash Flow and Profit Sharing in Mudharabah

Profit sharing in Mudharabah is contingent on the profitability and cash flow of the business. When a company maintains a positive cash flow, it signifies that the business is efficiently generating cash, allowing for a smooth distribution of profits. This positive cash flow also suggests that the business can reinvest in operations, thereby potentially increasing future profits and returns for the Mudharabah contract parties.

Conversely, a negative cash flow indicates potential liquidity issues, which can affect the timing and amount of profit distribution. In such cases, even if the company shows an accounting profit, the lack of actual cash can delay profit sharing, causing dissatisfaction among investors. Efficient cash flow management is thus vital to ensuring that the business can honour its profit-sharing commitments in a timely manner.

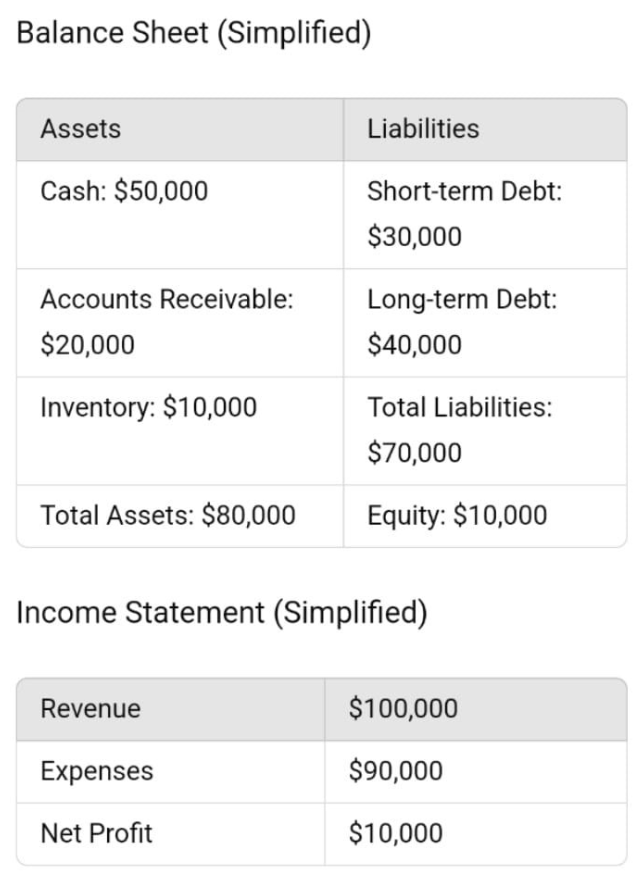

Practical Example: Financial Statement

In this example, the company has a net profit of $10,000. However, the cash flow from operations shows:

**Cash Flow from Operations (Simplified)**

| Net Profit | $10,000 |

| Adjustments for non-cash items | $5,000 |

| Changes in Working Capital | $15,000 |

| Net Cash from Operations | $0 |

Despite the net profit, the net cash from operations is zero due to changes in working capital. This scenario highlights that while the company is profitable on paper, its cash flow situation prevents immediate profit distribution. Hence, the Mudharabah partners must wait for the cash flow to improve before receiving their share of profits.

Effective cash flow management is crucial in Mudharabah contracts to ensure timely and adequate profit sharing. Both positive and negative cash flows significantly impact the ability of a business to meet its profit-sharing obligations, highlighting the importance of cash flow analysis alongside traditional profitability measures.

Wallahu a’lam

More articles at blog.zeedsharia.com

Halal Investment Zeedsharia.com

References

Harvard Business Review. (n.d.). Cash flow analysis is the key to business success. Retrieved from https://hbr.org

Investopedia. (n.d.). The basics of profit sharing. Retrieved from https://www.investopedia.com

Investopedia. (n.d.). Understanding cash flow statements. Retrieved from https://www.investopedia.com

ResearchGate. (n.d.). Mudharabah: Concepts and applications in Islamic finance. Retrieved from https://www.researchgate.net

Visser, H. (2019). Islamic finance: principles and practice (3rd ed.). Edward Elgar Publishing.