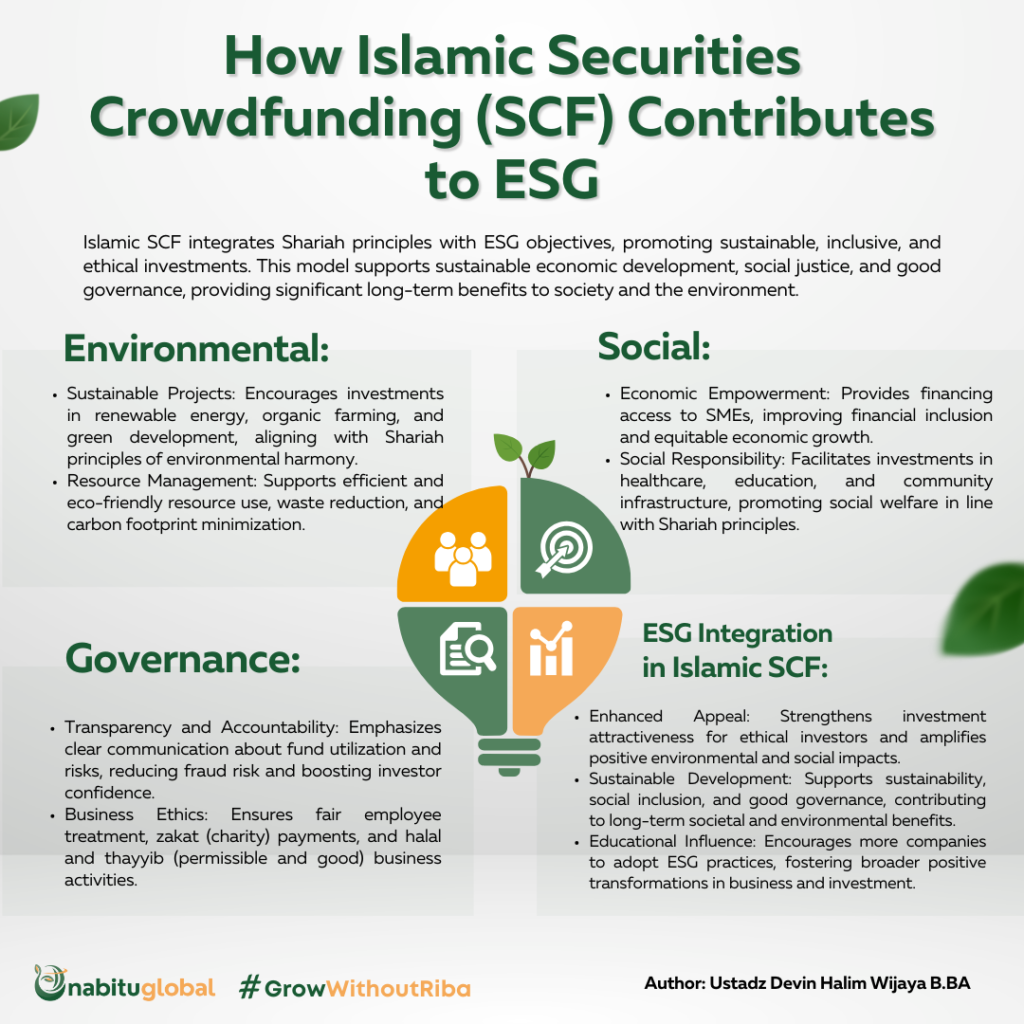

How Islamic Securities Crowdfunding (SCF) Contributes to Environmental, Social, and Governance (ESG)

Islamic Securities Crowdfunding (SCF) is an innovative funding model that allows individuals and companies to invest in business projects through the offering of shares or bonds in accordance with Shariah principles. These principles prohibit riba, gharar, and haram business activities, creating an ethical and sustainable investment system. In addition to promoting business ethics, Islamic SCF also has the potential to significantly contribute to environmental, social, and governance (ESG) aspects.

By supporting environmentally friendly projects, empowering communities, and implementing transparent and accountable governance, the Islamic SCF not only offers profitable investment opportunities but also supports sustainable development goals (SDGs).

This article will discuss how Islamic SCF can help fulfil ESG principles in investment and development.

Definition of Islamic Securities Crowdfunding (SCF)

Islamic Securities Crowdfunding (Islamic SCF) is a funding model that allows individuals and companies to invest in business projects through the offering of shariah-compliant shares, or sukuk, through a platform authorised by the Financial Services Authority (OJK). These principles prohibit riba (interest), gharar (excessive uncertainty), and haram (prohibited) business activities, such as gambling or alcohol production. This approach creates opportunities to support businesses that are not only financially profitable but also in line with Shariah and moral values.

Definition of Environmental, Social, and Governance (ESG)

Environmental, Social, and Governance (ESG) is a framework used to evaluate the extent to which a company or investment takes into account environmental, social, and governance factors in its operations and decision-making. These three components include:

1. Environmental: This refers to the impact that business activities have on the environment. Factors considered include waste management, energy use, carbon emissions, sustainability of natural resources, and climate change mitigation efforts.

2. Social: The social aspect covers the impact of the business on society and other stakeholders. This includes labour policies, occupational health and safety, human rights, community relations, and contributions to social development.

3. Governance: Governance refers to the internal practices and policies that determine how the company is managed. This includes leadership structure, board composition, transparency, business ethics, anti-corruption, and protection of shareholder rights.

Islamic SCF’s contribution to ESG

The contribution of Islamic SCF to the environmental, social, and governance (ESG) aspects can be explained as follows:

Environmental

1. Sustainable Projects: Islamic SCF can encourage investment in projects that focus on environmental sustainability, such as renewable energy, organic farming, or green development. As Shariah principles encourage harmony with nature, these projects naturally fit the ESG objectives.

2. Resource Management: Islamic SCF can support investments that tend to prioritise efficient and environmentally friendly resource use. This includes waste reduction, efficient energy use, and carbon footprint minimization.

Social

1. Economic Empowerment: The Islamic SCF opens up access to finance for small and medium enterprises (SMEs) that may struggle to obtain capital through traditional channels. This can improve financial inclusion and support more equitable economic growth.

2. Social Responsibility: Investments facilitated by Islamic SCF often include projects that provide social benefits, such as the construction of healthcare facilities, education, and community infrastructure. Shariah principles promote social welfare and care for others, which is in line with the social objectives in ESG.

Governance

1. Transparency and Accountability: The Islamic SCF emphasises the importance of transparency and accountability in business operations. Investors are clearly informed about how their funds will be utilised and what the associated risks are. This helps reduce the risk of fraud and increases investor confidence.

2. Business Ethics: Shariah principles require businesses to operate ethically and responsibly. This includes fair treatment of employees, payment of zakat (charity), and ensuring that all business activities are halal (permissible) and thayyib (good).

ESG Integration in Islamic SCF

The integration of ESG principles in Islamic SCF not only strengthens the investment appeal for those who want to invest ethically but also increases the positive impact on the environment and society. By supporting projects that focus on sustainability, social inclusion, and good governance, Islamic SCF can be a powerful tool to achieve sustainable development goals (SDGs).

In addition, Islamic SCF can also educate and inspire more companies to adopt ESG practices in their operations, thereby driving a broader positive transformation in the world of business and investment.

Islamic SCF has great potential to contribute to the environmental, social, and governance (ESG) aspects by promoting sustainable, inclusive, and ethical investments. By integrating Shariah principles with ESG objectives, Shariah SCF can support sustainable economic development, social justice, and good governance, thereby providing long-term benefits to society and the environment.

Wallahu a’lam

References

1. Ethis. (n.d.). Islamic Crowdfunding: A Shariah-Compliant Investment Alternative. Retrieved from https://ethis.co/islamic-crowdfunding-a-shariah-compliant-investment-alternative/

2. Kontan. (2022). Catat Daftar Fintech Securities Crowdfunding Syariah Resmi yang Kantongi Izin OJK. Retrieved from https://keuangan.kontan.co.id/news/catat-daftar-fintech-securities-crowdfunding-syariah-resmi-yang-kantongi-izin-ojk

3. Kompas. (2022). Daftar Fintech Securities Crowdfunding Syariah yang Dapat Izin OJK. Retrieved from https://money.kompas.com/read/2022/01/11/090000526/daftar-fintech-securities-crowdfunding-syariah-yang-dapat-izin-ojk

4. Mckinsey & Company. (2022). Environmental, Social, & Governance (ESG). Retrieved from https://www.mckinsey.com/business-functions/sustainability/our-insights/environmental-social-and-governance-esg

5. Corporate Finance Institute. (2023). ESG (Environmental, Social, & Governance). Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/other/esg-environmental-social-governance/

6. MSCI. (2023). Sustainable Investing. Retrieved from https://www.msci.com/our-solutions/sustainable-investing

One Comment