Gross vs Net Profit: Understanding the Difference for Your Business

Running a business involves careful financial calculations, especially when it comes to calculating profit. Two terms that often come up in this context are gross profit and net profit. Understanding the difference between the two is crucial, as they can influence business decisions, pricing strategies, and the overall financial health of your business. This article will explain in detail the differences between gross profit and net profit, and how each affects your business.

1. What is Gross Profit?

Gross profit is the result of total revenue earned by a company after deducting direct costs associated with producing goods or services, commonly referred to as cost of goods sold (COGS). In this context, direct costs may include raw material costs, direct labor, and other operational production costs.

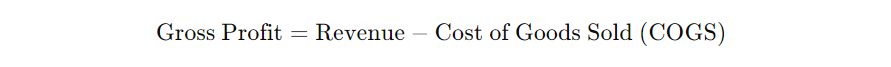

The formula to calculate gross profit is:

Gross profit provides an overview of how effectively the business generates profit from its production process. However, this value does not reflect the actual profit, as it does not account for other expenses such as operational costs, taxes, loan interest, and more.

2. What is Net Profit?

Unlike gross profit, net profit is the final profit earned by a company after all expenses, including operational costs, loan interest, taxes, depreciation, and other charges, have been deducted from total revenue. Net profit offers a more accurate picture of the actual profit a company earns after accounting for all business expenses.

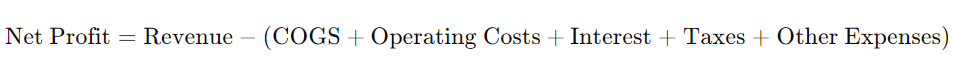

The formula for net profit is:

In other words, net profit is the remaining profit that can be reinvested into the business, paid out as dividends to shareholders, or retained as earnings.

Also read:Book Value Per Share:Is It Important for Investors?

3. Differences Between Gross Profit and Net Profit

The key difference between gross profit and net profit lies in the types of expenses deducted from revenue. Below are the major distinctions:

- Expenses Deducted: In gross profit, only direct costs related to production are deducted, while in net profit, all expenses, including operating costs, taxes, interest, and other expenses, are deducted.

- Function: Gross profit is used to assess production efficiency or cost of goods sold, whereas net profit reflects the overall profitability of the business after considering all cost factors.

- Impact on Business Strategy: Gross profit helps businesses determine the selling price of products to remain competitive and profitable. On the other hand, net profit is used to measure long-term financial health and decide how to allocate resources.

4. The Importance of Knowing Gross and Net Profit for Your Business

Understanding the difference between gross profit and net profit is crucial for sustaining your business. Both have distinct uses in strategic decision-making:

- Evaluating Production Efficiency: Gross profit helps business owners evaluate the efficiency of their production process. For example, if the gross profit margin is low, there may be issues with production efficiency or excessively high costs of goods sold.

- Long-Term Planning: Net profit is more relevant for assessing the overall profitability of a business. Knowing the net profit allows you to plan for business growth, increase investment, or decide whether there is a need to reduce inefficient operational expenses.

Also read:Return on Investment:Crucial to Understand Your Investment Outcomes

5. Example of Financial Statements and Gross Profit vs Net Profit Calculation

Below is a simple financial statement example from a fictional company, PT Sukses Jaya, for the first quarter of 2024:

| Component | Amount (Rp) |

|---|---|

| Revenue | 500,000,000 |

| Cost of Goods Sold (COGS) | 300,000,000 |

| Operating Costs | 100,000,000 |

| Loan Interest | 20,000,000 |

| Taxes | 30,000,000 |

From the above data, we can calculate gross profit and net profit as follows:

- Gross Profit:

Gross Profit=Revenue−Cost of Goods Sold (COGS)

Gross Profit=500,000,000−300,000,000=200,000,000

So, the gross profit for PT Sukses Jaya in the first quarter is Rp 200,000,000.

- Net Profit:

Net Profit=Revenue−(COGS+Operating Costs+Interest + Taxes)

Net Profit=500,000,000−(300,000,000+100,000,000+20,000,000+30,000,000)=500,000,000−450,000,000=50,000,000

Thus, the net profit for PT Sukses Jaya is Rp 50,000,000.

6. Conclusion

Understanding the difference between gross profit and net profit is crucial to running a successful business. Gross profit provides information about how efficiently a company produces goods or services, while net profit gives a complete picture of a business’s profitability after all expenses are accounted for. A solid understanding of these two concepts can help business owners make better decisions in pricing, cost management, and planning for growth and sustainability.

Also read:Liquidity Ratio: Can Your Business Pay Short-Term Debt?

References

- Financestrategists. (n.d.). Gross profit vs net profit. Retrieved from https://www.financestrategists.com/wealth-management/financial-statements/gross-profit-vs-net-profit/

- StockGuide. (n.d.). Mengenal gross profit margin, operating profit margin, dan net profit margin. Retrieved from https://stockguide.id/mengenal-gross-profit-margin-operating-profit-margin-dan-net-profit-margin/

- Kledo. (n.d.). Gross profit margin: Pengertian dan cara menghitungnya. Retrieved from https://kledo.com/blog/gross-profit-margin/

- Investopedia. (n.d.). What is the difference between gross profit margin and net profit margin? Retrieved from https://www.investopedia.com/ask/answers/021215/what-difference-between-gross-profit-margin-and-net-profit-margin.asp

- Investing. (n.d.). Pengertian gross profit margin dan net profit margin. Retrieved from https://id.investing.com/analysis/pengertian-gross-profit-margin-dan-net-profit-margin-200200125