Net Present Value: Important to Know The Impact of Time on Your Investment Value

Net Present Value (NPV) is a commonly used method for evaluating the feasibility of an investment. By calculating NPV, investors can determine whether an investment will be profitable or not. NPV takes into account the time value of money—meaning that money received today is worth more than the same amount received in the future. One of the critical factors influencing NPV is time, as the distribution of cash flows over time significantly affects the overall value of the investment. This article will explore how time affects your investment’s value through NPV and incorporate a detailed example with specific NPV calculations.

What is Net Present Value (NPV)?

NPV is the difference between the present value of future cash flows and the initial cost of an investment. It allows investors to assess the value of an investment by considering that money received in the future is not as valuable as money received today due to risks, inflation, and the opportunity to earn returns elsewhere.

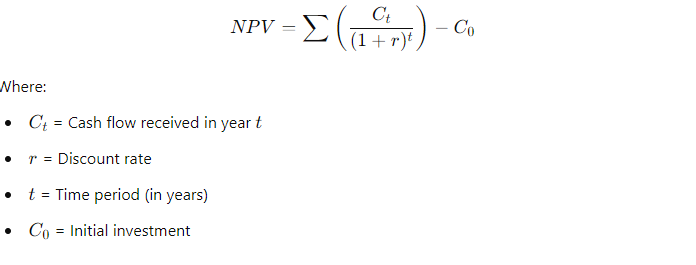

The general formula for NPV is:

If the NPV is positive, the investment is considered profitable. If the NPV is negative, the investment is likely unprofitable.

Also read:Importance of Financial Ratios for Investment

What is a Discount Rate?

One of the key components of NPV is the discount rate. The discount rate is the interest rate used to discount future cash flows to their present value. It reflects both the time value of money and the risk associated with future cash flows. The higher the discount rate, the less future cash flows are worth today. This means that investments with long-term returns will have lower NPVs when using higher discount rates, as the cash flows are heavily discounted.

The discount rate incorporates several important factors:

- Risk Measurement: The higher the risk, the higher the discount rate should be. For example, risky stock investments will typically have a higher discount rate than safer investments like government bonds.

- Inflation and Time Value of Money: The discount rate accounts for inflation, ensuring that future cash flows are discounted based on the diminishing purchasing power of money over time.

- The Effect of Time on Investment: The longer it takes to receive cash flows from an investment, the lower the present value of those cash flows. The discount rate makes it possible to quantify this effect and factor it into the decision-making process.

The Importance of Time in NPV

Time is a crucial factor in determining the value of an investment. Here’s why:

- Time Value of Money: Money has more value today than in the future because it can be invested to earn additional returns. Therefore, the longer it takes to receive future cash flows, the less valuable they are. NPV helps calculate how much these future cash flows are worth today by discounting them over time.

- Higher Risk with Longer Timeframes: The longer the time horizon of an investment, the greater the uncertainty and risk. Market fluctuations, inflation, and unforeseen events all increase over time. Hence, longer-term investments usually require a higher discount rate to account for these risks, reducing the NPV.

- Faster Cash Flows Mean Higher NPV: Investments that generate returns quickly tend to have higher NPVs because their cash flows are worth more today. Conversely, slower returns will result in a lower NPV due to the compounding effect of the discount rate over time.

Also read:Return on Investment:Crucial to Understand Your Investment Outcomes

Example: Two Investments with the Same Initial Capital and Profit

To illustrate how time affects NPV, let’s look at two investment scenarios with the same initial capital and total profit but different cash flow distributions:

- Initial Investment: Rp100,000,000

- Total Income: Rp130,000,000

- Discount Rate: 10% (applied to both scenarios)

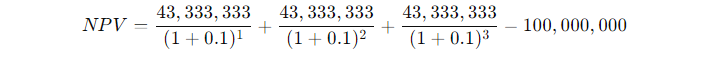

Scenario 1: 10% Annual Profit Over 3 Years

In this scenario, the total profit of Rp130,000,000 is distributed evenly over 3 years. We can calculate the NPV as follows:

This results in an NPV of Rp7,763,586 (positive), indicating that the investment is profitable. The quick return of cash flows over 3 years helps maintain a higher present value, making the investment more attractive.

Scenario 2: 6% Annual Profit Over 5 Years

In this scenario, the same total profit of Rp130,000,000 is distributed over 5 years. The NPV calculation is:

This results in an NPV of Rp -1,439,543 (negative), showing that the investment is unprofitable. Although the total profit is the same, the longer distribution period causes the cash flows to be discounted more heavily, leading to a negative NPV.

Conclusion

This example clearly demonstrates how time plays a crucial role in determining the NPV of an investment. Even with the same initial capital and total profit, the timing of cash flows dramatically affects the outcome. Investments with quicker cash flows tend to be more valuable, as the time value of money works in their favor. On the other hand, investments with slower cash flows face greater discounting, leading to lower NPVs, which may make them less attractive.

In conclusion, NPV is a powerful tool for evaluating the profitability of investments, but investors must always consider the timing of cash flows, the discount rate, and the risks associated with longer-term investments when making decisions.

Also read: Maximize Returns with Compound Growth

References

Corporate Finance Institute. (2023). Net Present Value (NPV). Retrieved from https://corporatefinanceinstitute.com/resources/valuation/net-present-value-npv/

Investopedia. (2023). Net Present Value (NPV). Retrieved from https://www.investopedia.com/terms/n/npv.asp

Scale Ocean. (2023). Net Present Value (NPV). Retrieved from https://scaleocean.com/id/blog/belajar-bisnis/net-present-value

Invesnesia. (2023). Net Present Value (NPV) Adalah: Rumus, Contoh Soal, Cara Menghitung. Retrieved from https://www.invesnesia.com/net-present-value-npv-adalah-rumus-contoh-soal-cara-menghitung/

Investbro. (2023). Net Present Value (NPV). Retrieved from https://investbro.id/net-present-value-npv/

Accurate.id. (2023). Net Present Value (NPV): Pengertian, Rumus, dan Contohnya. Retrieved from https://accurate.id/akuntansi/net-present-value