Investment as a Shar’i Way to Reduce Zakat, How is it Related?

Investing involves allocating money or assets held by individuals or groups with the goal of growing their wealth over time. This can be done through various investment options like stocks, bonds, real estate, or commodities. The purpose of investment is to obtain a return on assets with a higher value in the future. Investment itself is a way for a person to maintain their assets and grow those assets.

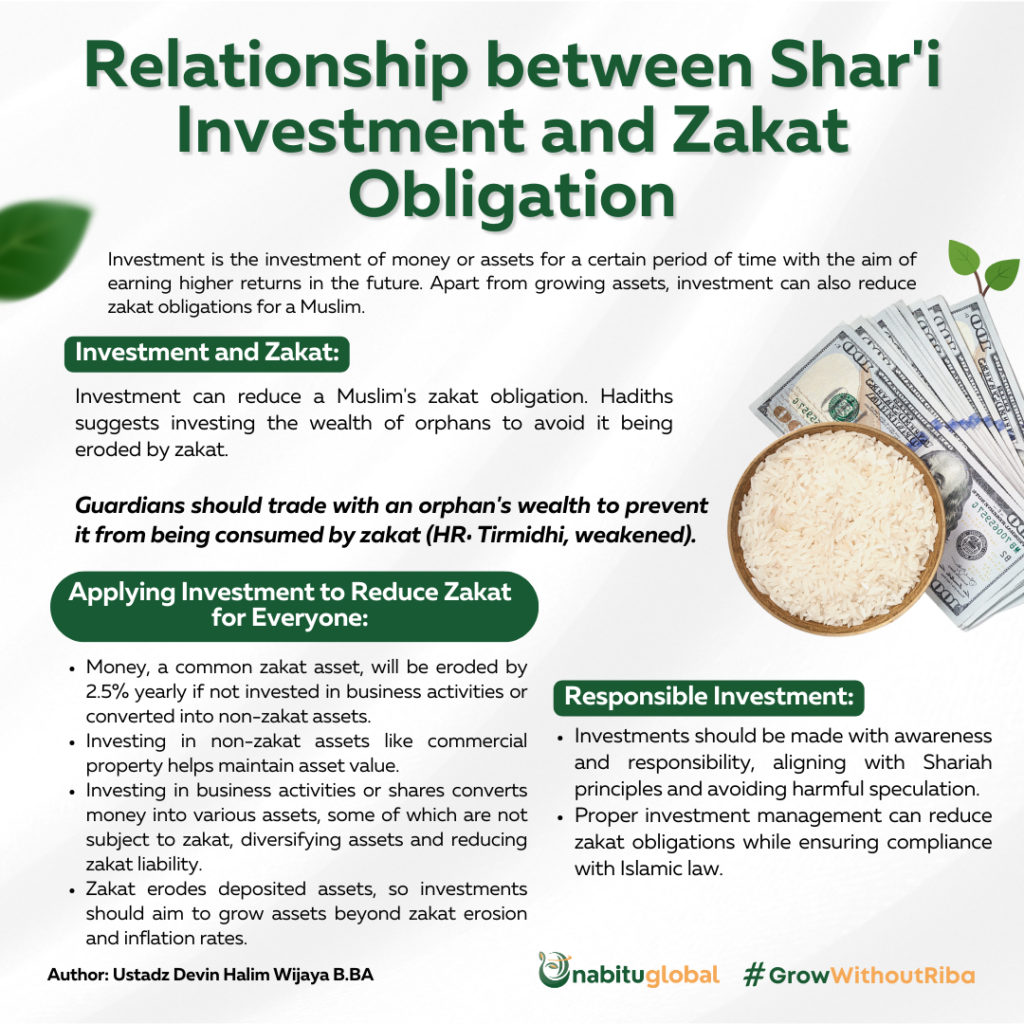

However, investment can also be a means to reduce a Muslim’s zakat obligation. This article will discuss how investment can be a way to reduce zakat obligations through the atsar of Umar bin Khattab Radhiyallahu anhu.

Dalils on Investment as a Deduction From Zakat Obligation

There are several words from the hadith and atsar that contain the same meaning: The wealth of orphans should be invested so that it is not subject to zakat. Some of these texts are as follows:

ألا من ولي يتيماً وله مال فليتجر له بماله ولا يتركه حتى تأكله الصدقة” (رواه الترمذي وضعفه

‘Whoever is the guardian of an orphan and has wealth, let him trade with his wealth and let him not leave it until it is consumed by charity.’ (HR: Tirmidhi and weakened).

ابتغوا في مال اليتيم أو أموال اليتامى لا تذهبها ولا تستهلكها الصدقة” (رواه الشافعي في الأم والبيهقي في السنن الكبرى

‘Strive with the property of an orphan or the property of an orphan, so that charity does not deprive it nor exhaust it.’ (Narrated by Imam Shafi’i in al-Umm and al-Baihaqi in as-Sunnah al-Kubra)

اتجروا في أموال اليتامى لا تأكلها الصدقة” (وقال البيهقي هذا إسناد صحيح وله شواهد عن عمر رضي الله عنه

‘Trade in the wealth of orphans so that charity does not exhaust it.’ (HR. Baihaqi (may Allah be pleased with him) with a valid chain of transmission and a witness from ‘Umar (may Allah be pleased with him).

Explanation of The Dalils

This Hadīth teaches us to utilise the wealth of orphans wisely by investing their wealth. The general purpose of investment is to grow the asset, but the above Hadīth adds another purpose of investing the orphan’s wealth, which is to prevent zakat from always eroding the orphan’s stored wealth because the stored money will always be subject to zakat of 2.5% per year.

The Relationship Between The Dalils and Investment as A Deduction for Zakat

Although the dalils are specific to the wealth of orphans, the explanation of how investment and trade can be a means of reducing the obligation and burden of zakat for everyone is as follows:

1. Money is one of the most common types of assets subject to zakat, zakat will continue to erode money as much as 2.5% per year if the money is not used in business activities or converted into assets that are not subject to zakat, Investing in assets that are not subject to zakat such as commercial property is one way to maintain the value of our assets from zakat erosion.

2. When a person invests in business activities either directly or in the form of purchasing shares in the capital market or crowdfunding, he is converting his money into various types of assets according to the proportion of assets in the company, some of these assets are assets that are not subject to zakat such as business equipment, property, office equipment, and so on. By understanding this, investing can be a means of diversifying assets from wholly zakat-obligatory to partly zakat-obligatory and partly not zakat-obligatory.

3. Zakat itself has the nature of eroding the assets that are deposited, so that the erosion must be overcome by growing the assets beyond the percentage of erosion of the assets. Investment can be a means to deal with the erosion of wealth due to zakat and inflation, especially if the investment is made in assets with high value growth or assets that can produce large cash flows.

Investments made with full awareness and responsibility can be a means to reduce zakat. However, we must ensure that such investments are in accordance with Shariah principles and do not involve harmful speculation. May Allah ﷻ bless our efforts in managing our wealth well and providing benefits to others.

References

- الضوابط الشرعية للتعامل مع أموال الأيتام – حسام الدين عفانه. (n.d.). Ar.islamway.net. Retrieved May 26, 2024, from https://ar.islamway.net/fatwa/42543/

- ابتغوا بأموال اليتامى لا تأكلها الصدقة – السنن الكبرى للبيهقي. (n.d.). Surahquran.com. Retrieved May 26, 2024, from https://surahquran.com/Hadith-126722.html

- ألا من ولي يتيما له مال فليتجر فيه – سنن الترمذي. (n.d.). Hadithprophet.com. Retrieved May 26, 2024, from https://hadithprophet.com/hadith-58858.html#google_vignette

One Comment