How Mudharabah Akad Works in Sukuk Issuance

The Islamic capital market is one of the innovations in the field of Islamic finance that presents Islamic contracts and values in capital practices and transactions in the capital market.

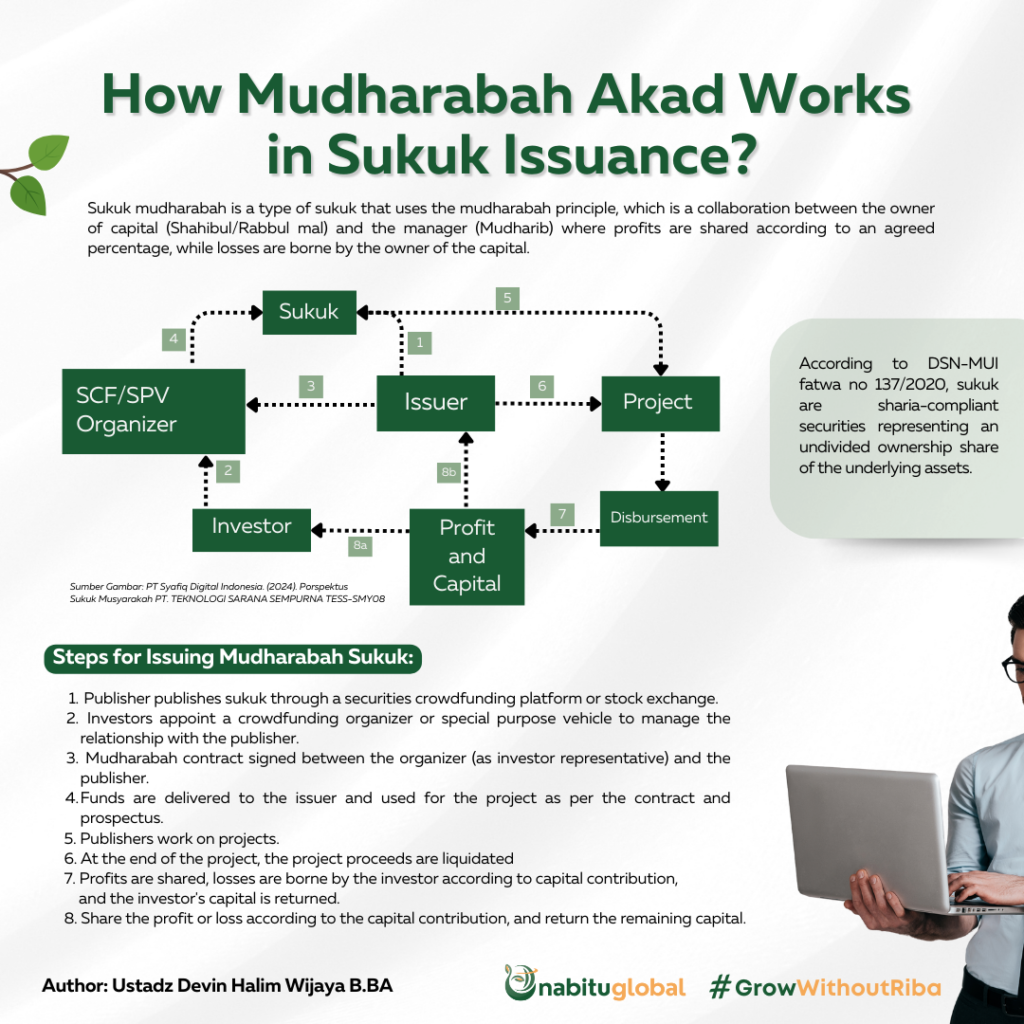

One of the innovations in securities issuance in the Islamic capital market is sukuk. Sukuk itself is defined based on the fatwa of the National Sharia Council of the Indonesian Ulama Council (DSN-MUI) no 137 / DSN-MUI / X / 2020 concerning sukuk as Sharia Securities in the form of certificates or proof of ownership of equal value and representing an indefinite ownership share (musya’) of the underlying assets (Sukuk assets / Ushul al-Sukuk) after the receipt of sukuk funds, the closing of orders and the start of the use of funds according to their designation.

Sukuk is generally considered a financial instrument that is a sharia alternative to bonds. One of the most popular types of sukuk is the mudharabah sukuk, which operates on the principle of mudharabah. This article will discuss the definition of mudharabah contract and its use in sukuk issuance.

Definition of Mudharabah

Mudharabah itself has several definitions, as follows:

The definition of mudharabah according to the fatwa of the National Sharia Council of the Indonesian Ulama Council (DSN-MUI) no 115/DSN-MUI/IX/2017 concerning mudharabah contracts is:

‘Akad mudharabah is a business cooperation contract between the owner of capital (malik/shahib al-mal) who provides all the capital and the manager (’amil/mudharib) and the profit of the business is divided between them according to the ratio agreed in the contract.’

The definition of mudharabah according to the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) sharia standard is:

المضاربة شركة في الربح بمال من جانب (رب المال) و عمل من جانب آخر (المضارب)

Mudharabah (is) a union in profit with wealth from one party (Rabbul mal) and work from the other party (Mudharib).

Based on the two definitions above, mudharabah is a co-operative contract between two parties where one party provides the capital (Shahibul/Rabbul mal) and the other party offers the work (Mudharib). In a mudharabah contract, the capital provider is solely responsible for losses while both parties share profits according to a predetermined percentage of profits.

Evidence of Mudharabah

Mudharabah contracts are mentioned in the following hadith:

ثلاث فيهن البركة، البيع إلى أجل، والمقارضة، وخلط البر بالشعير للبيت لا للبيع

3 things in which there is barakah: delayed sale, muqaradhah (mudharabah), and mixing barley with wheat for household use not for sale (Ibn Majah).

Issuance of Mudharabah Sukuk

In the issuance of Mudharabah sukuk, the issuer as Mudharib through the issuance of mudharabah sukuk collects funds from investors as Shahibul mal and channelling them to the project mentioned in the prospectus or business proposal of the mudharabah sukuk issuance. The profit generated from the project is then distributed in accordance with the profit sharing ratio mentioned in the prospectus or business proposal for the issuance of sukuk mudharabah. This scheme or the modus operandi is explained in the following illustration:

1) The issuer will offer the Sukuk through a securities crowdfunding platform or stock exchange.

2) Investors who invest their funds in the Sukuk represent the securities crowdfunding organiser or special purpose vehicle to manage their relationship with the issuer.

3) A mudharabah contract is signed between the securities crowdfunding organiser or special purpose vehicle as the investor’s representative and the issuer.

4) Delivery of the invested amount to the issuer through Sukuk issuance.

5) Disbursement and utilisation of funds invested in the project as per the contract and prospectus.

6) The issuer undertakes the project.

7) At the end of the project, the project proceeds are liquidated, either by monetizing the entire project proceeds or by valuing the entire project proceeds or by what is known as legal liquidation.

8) Share the profits between the investors and return their capital, or bear the losses for the investors according to their contribution to the capital and return the remaining capital.

Mudharabah is one of the contracts used for business financing, which makes it very suitable for sukuk issuance. May Allah ﷻ help us in obtaining sharia-compliant business capital, especially with mudharabah contracts.

Wallahu a’lam

References

- PT Shafiq Digital Indonesia. (2024). Prospektus Sukuk Musyarakah PT TEKNOLOGI SARANA SEMPURNA TESS-SMY08 [Review of Prospektus Sukuk Musyarakah PT TEKNOLOGI SARANA SEMPURNA TESS-SMY08]. PT Shafiq Digital Indonesia.

- المضاربة تعريفها وأدلة مشروعيتها. (2022, June 2). E3arabi – إي عربي. https://e3arabi.com/%D8%A5%D8%B3%D9%84%D8%A7%D9%85/%D8%A7%D9%84%D9%85%D8%B6%D8%A7%D8%B1%D8%A8%D8%A9-%D8%AA%D8%B9%D8%B1%D9%8A%D9%81%D9%87%D8%A7-%D9%88%D8%A3%D8%AF%D9%84%D8%A9-%D9%85%D8%B4%D8%B1%D9%88%D8%B9%D9%8A%D8%AA%D9%87%D8%A7/

- Majelis Ulama Indonesia, D. S. N. (2017). Fatwa Dewan Syariah Nasional-Majelis Ulama Indonesia No: 115/DSN-MUI/IX/2017 [Review Of Fatwa Dewan Syariah Nasional-Majelis Ulama Indonesia No: 115/DSN-MUI/IX/2017].

- المعايير الشرعية (١-٤٥). (2015).