EBITDA: How to Understand Operational Profit

EBITDA is one of the essential financial indicators used to assess a company’s performance. This term is frequently used by financial analysts, investors, and management to understand how efficiently a company generates profits from its core operations. This article will discuss what EBITDA is, how to calculate it, why it is important, and some criticisms of its use.

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. Simply put, EBITDA measures a company’s operational income before accounting for interest expenses, taxes, depreciation, and amortization. The purpose is to provide a clearer picture of core operational profitability without being influenced by non-operational and non-cash expenses (Corporate Finance Institute, 2024).

According to Accurate.id (2024), EBITDA is often used because it enables fairer comparisons between companies within the same industry. This is due to the fact that EBITDA eliminates factors such as differences in capital structure, tax policies, and accounting methods, which often make it challenging to compare the performance of one company with another. Thus, EBITDA is frequently considered a standard metric to assess a company’s profitability among business players and investors.

How to Calculate EBITDA

In general, there are two approaches to calculating EBITDA: using operating income and using net income. Here are the formulas:

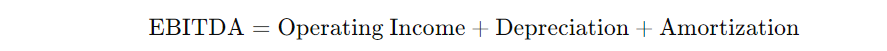

Using Operating Income:

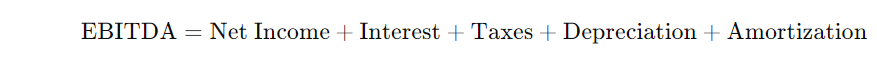

Using Net Income:

Also read:Gross vs Net Profit: Understanding the Difference for Your Business

Example Calculation of EBITDA

Example Calculation Using Operating Income:

Suppose a company has the following financial details:

- Operating Income (EBIT): Rp1,200,000,000

- Depreciation: Rp150,000,000

- Amortization: Rp50,000,000

Using the first formula, EBITDA can be calculated as:

EBITDA=1,200,000,000+150,000,000+50,000,000=Rp1,400,000,000

Example Calculation Using Net Income

For another example, if the same company has the following details:

- Net Income: Rp1,000,000,000

- Interest Expense: Rp200,000,000

- Taxes: Rp100,000,000

- Depreciation: Rp150,000,000

- Amortization: Rp50,000,000

The calculation using the second formula would be:

EBITDA=1,000,000,000+200,000,000+100,000,000+150,000,000+50,000,000=Rp1,500,000,000

Why is EBITDA Important?

EBITDA is very useful in assessing operational profitability because it eliminates the impact of capital structure, tax differences, and accounting policies. As a result, EBITDA allows investors and analysts to focus on the company’s core performance. In the context of investment, EBITDA also provides a clear picture of potential operational revenue before non-cash and non-operational expenses are factored in (Investopedia, 2024).

Also read:Project Based vs Equity Based Financing

The Use of EBITDA in Financial Analysis

One of the major benefits of EBITDA is its ability to present a more neutral performance indicator, particularly when comparing companies operating in the same sector but having different capital structures or accounting policies. Therefore, EBITDA is often the main benchmark for investors looking to compare the performance of various companies within a particular industry.

Furthermore, EBITDA is very useful for internal evaluation by company management. In managing a business, management can use EBITDA to evaluate operational efficiency and plan strategic steps ahead. For example, if a company’s EBITDA increases year-over-year, this may indicate that the company’s operations are becoming more efficient.

Limitations of EBITDA

Although EBITDA has significant benefits, its use is not without criticism. One of the main weaknesses of EBITDA is that this metric does not reflect the actual cash expenses required to meet obligations such as interest payments, taxes, and asset replacement through depreciation. EBITDA only measures operational performance before these costs are accounted for, which can paint an overly optimistic picture of profitability (Corporate Finance Institute, 2024).

In this regard, EBITDA can be seen as “hiding” some essential costs that may impact the company’s cash flow. For example, a company with high levels of debt might appear healthy in terms of EBITDA, but the reality is that the interest payments it must make are significant and could reduce actual profits. Therefore, in making investment decisions, investors should not rely solely on EBITDA but also consider other financial indicators such as net income, operational cash flow, and debt ratios.

Also read:Activity Ratios: Know How Your Business Performs

EBITDA vs. Operating Cash Flow

One key difference that needs to be understood is between EBITDA and operating cash flow. Many people mistakenly equate EBITDA with operating cash flow because both exclude depreciation and amortization. However, in reality, EBITDA does not consider changes in working capital and capital expenditures, which are crucial elements in measuring a company’s ability to generate cash flow.

Additionally, EBITDA does not indicate how much cash is generated from core operations that can be used to pay the company’s obligations or make strategic investments. Therefore, while EBITDA is a useful analysis tool, its use should always be balanced with a more comprehensive analysis of operating cash flow.

Conclusion

EBITDA is an essential indicator that provides insights into a company’s operational profitability. By understanding EBITDA, management can assess operational efficiency, while investors can compare performance across different companies within the same industry. However, it is essential to remember that EBITDA is not the only measure of profitability, and investors need to consider other metrics to get a more comprehensive picture of the company’s financial health.

In conclusion, understanding EBITDA helps stakeholders make better decisions related to the company’s operations and investments. Nevertheless, it is crucial to be aware of its limitations to avoid misjudging a company’s financial performance.

Also read:Solvency Ratios: Can Your Business Pay Off Future Debts?

References

- Corporate Finance Institute. (2024). What is EBITDA?. Retrieved from https://corporatefinanceinstitute.com/resources/valuation/what-is-ebitda/

- Accurate.id. (2024). Pengertian EBITDA: Fungsi, Cara Menghitung dan Kekurangannya. Retrieved from https://accurate.id/ekonomi-keuangan/pengertian-ebitda/

- Jurnal.id. (2024). Apa Itu EBITDA dan Bagaimana Cara Perhitungannya?. Retrieved from https://www.jurnal.id/id/blog/perhitungan-ebitda/

- Investopedia. (2024). EBITDA Definition. Retrieved from https://www.investopedia.com/terms/e/ebitda.asp