Return on Equity: How Shareholders Measure Their Returns

Return on Equity (ROE) is one of the most widely used financial metrics by investors to assess the profitability of a company. It provides a clear picture of how efficiently a company is using its shareholders’ equity to generate profits. In simpler terms, ROE shows how much profit a company makes with the money shareholders have invested. This article will delve deeper into the concept of ROE, how it is calculated, its importance for shareholders, and the factors that influence it.

Understanding Return on Equity

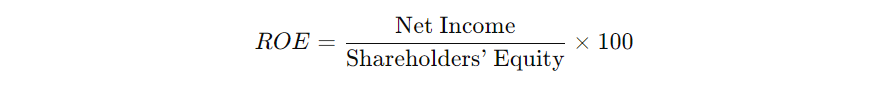

ROE is a ratio that measures the amount of net income returned as a percentage of shareholders’ equity. The formula for calculating ROE is:

For example, if a company has a net income of $2 million and shareholders’ equity of $10 million, the ROE is 20%. This means that for every dollar of equity, the company generates 20 cents in profit.

By measuring the profitability of a company in relation to the shareholders’ equity, ROE helps investors assess how effectively the company is utilizing its capital. A high ROE generally indicates that the company is managing its equity well and generating high returns, while a lower ROE suggests less efficient capital use.

Also read:Gross vs Net Profit: Understanding the Difference for Your Business

The Importance of ROE for Shareholders

- Indicator of Profitability

ROE provides investors with a quick snapshot of a company’s profitability. By showing how much return is generated from the capital invested by shareholders, ROE allows investors to evaluate whether the company is using their money efficiently. Companies with high ROE are generally seen as financially healthy and may offer better investment opportunities. - Investment Comparison Tool

Investors often use ROE to compare the performance of companies within the same industry. Since it measures how effectively a company is using its equity, it allows shareholders to assess which companies are maximizing their investments. However, it’s important to compare companies in similar industries since ROE can vary significantly between sectors. - Growth Indicator

Consistently high ROE over a period of time is an indicator of strong growth potential. Companies with growing ROE tend to have management teams that are effective at reinvesting earnings into profitable ventures. As a result, these companies are likely to continue performing well in the future, making them attractive to long-term investors. - Dividends and Reinvestment

A high ROE can also indicate that a company has more profits to either reinvest in the business or distribute as dividends to shareholders. Companies that maintain high ROE levels tend to generate higher shareholder value through reinvestments or increasing dividend payouts.

Factors Affecting ROE

Several factors can influence a company’s ROE, either boosting or lowering it. These include:

- Net Profit Margin

Net profit margin refers to how much of the revenue a company retains as profit after covering all expenses. Companies with higher profit margins typically have higher ROE since more of their earnings contribute to overall profitability. For example, a company with streamlined operations and low costs may report higher margins, thus increasing its ROE. - Asset Turnover

Asset turnover measures how efficiently a company utilizes its assets to generate revenue. Higher asset turnover indicates that the company is generating more sales per dollar of assets, which can lead to higher profitability and, consequently, a higher ROE. - Leverage (Debt)

Companies often use debt (or financial leverage) to enhance their ROE. By borrowing money, a company can increase its investment in assets without issuing new shares or using additional equity. As a result, the company may generate more profit relative to its equity base, boosting ROE. However, high debt levels can also introduce significant risk. If a company relies too much on debt, it may struggle during economic downturns, which could negatively affect both profitability and ROE. - Share Buybacks

Companies sometimes repurchase their own shares from the open market, reducing the total number of shares outstanding. This action decreases the denominator in the ROE equation (shareholders’ equity), thereby increasing ROE even if net income remains constant. However, while this strategy can be effective in boosting ROE, it does not necessarily reflect improved business performance. - Industry Norms

ROE can vary greatly between industries. For example, tech companies often have higher ROE because they require less capital to generate profits compared to industries like manufacturing or utilities, where large capital investments are necessary. Therefore, investors should always consider the industry average when evaluating a company’s ROE.

Also read:Activity Ratios: Know How Your Business Performs

Limitations of ROE

Despite its importance, ROE is not without limitations. One key limitation is that it does not account for financial risk. Companies with high debt levels may report a higher ROE because they have less equity, but this also increases their financial risk. In the event of an economic downturn or a drop in earnings, such companies may face liquidity problems.

Additionally, ROE can be manipulated by certain financial practices, such as share buybacks or heavy use of debt. These tactics can artificially inflate ROE without genuinely improving the company’s profitability or financial health. Investors should, therefore, use ROE in conjunction with other financial ratios, such as return on assets (ROA) and return on invested capital (ROIC), to gain a more comprehensive understanding of a company’s performance.

Finally, because ROE varies between industries, it may not always be useful to compare companies across different sectors. A ROE that seems low in one industry might actually be above average in another, so industry-specific benchmarks are essential when interpreting ROE.

Conclusion

ROE is a powerful tool for shareholders and investors looking to evaluate a company’s ability to generate profit from its equity. A high ROE indicates that a company is using its shareholders’ equity effectively, which is a positive signal for potential investors. However, it’s important to recognize that ROE is not a standalone measure of success. Investors should consider additional factors, such as a company’s use of leverage, industry benchmarks, and other financial ratios, to make well-informed investment decisions.

By understanding ROE and its implications, shareholders can better assess the potential returns on their investments, compare companies within the same industry, and predict future growth prospects.

Also read:Liquidity Ratio: Can Your Business Pay Short-Term Debt?

References:

- Wall Street Prep. Return on Equity (ROE). Retrieved from https://www.wallstreetprep.com/knowledge/return-on-equity-roe/

- Corporate Finance Institute. What is Return on Equity (ROE)? Retrieved from https://corporatefinanceinstitute.com/resources/accounting/what-is-return-on-equity-roe/

- OCBC NISP. ROE adalah: Pengertian dan Cara Menghitung Return on Equity. Retrieved from https://www.ocbc.id/id/article/2021/08/20/roe-adalah

- Investopedia. Return on Equity (ROE). Retrieved from https://www.investopedia.com/terms/r/returnonequity.asp