Solvency Ratios: Can Your Business Pay Off Future Debts?

Solvency ratios are vital indicators of a company’s long-term financial health. They provide insight into a business’s ability to meet its long-term debt obligations without jeopardizing its operational viability or shareholders’ equity. While businesses may face periods of financial strain, maintaining strong solvency ratios can significantly reduce financial risk and enhance creditworthiness, making it easier for companies to attract investors and secure loans.

In this expanded version, we will dive deeper into what solvency ratios are, why they are important, the different types of solvency ratios, and how businesses can improve their solvency over time.

What Are Solvency Ratios?

Solvency refers to a company’s ability to sustain its operations by paying off long-term liabilities, including loans, bonds, or other financial obligations due in more than a year. Unlike liquidity, which measures the ability to meet short-term obligations, solvency focuses on the long-term sustainability of the business.

A company with a high solvency ratio is in a better financial position to weather downturns, invest in growth, and maintain operations. On the other hand, a company with a low solvency ratio may be at risk of financial distress, making it harder to attract investors, secure loans, or continue operations during economic uncertainty.

Solvency ratios are essential for business owners, creditors, and investors, as they reflect the overall financial stability of the company. By examining these ratios, stakeholders can determine how reliant a company is on debt and whether it has enough resources to cover future liabilities.

Also read:Price to Earnings and Its Importance for Investors

Types of Solvency Ratios

There are several solvency ratios that businesses use to evaluate their financial standing. Each ratio provides a different perspective on how the company manages debt, assets, and profitability.

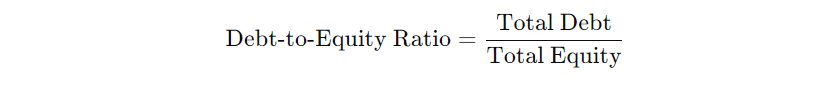

Debt-to-Equity Ratio

The debt-to-equity ratio compares a company’s total debt to its shareholders’ equity. It reveals how much of the company’s assets are financed through debt versus equity. A high ratio indicates that the company relies more on debt for its operations, which can increase financial risk. Conversely, a lower ratio suggests that the company is less dependent on external borrowing. The formula is:

For instance, if a company has $3 million in debt and $1.5 million in equity, its debt-to-equity ratio would be 2:1. A ratio of 2:1 implies that the company has twice as much debt as it has equity, which may raise concerns about its ability to manage its obligations in the long run.

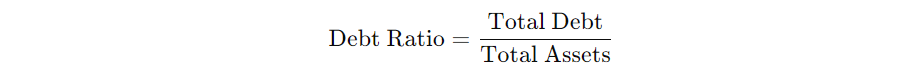

Debt Ratio

This ratio measures the proportion of a company’s total assets that are financed through debt. The debt ratio highlights the company’s overall leverage. A higher ratio indicates a higher level of debt relative to the company’s assets, potentially signaling that the company may face solvency issues if revenues decline. The formula is:

For example, if a company has $2 million in debt and $5 million in assets, its debt ratio is 0.4, or 40%. This means that 40% of the company’s assets are financed by debt, which is a reasonable level for many industries but could be concerning in sectors with high volatility.

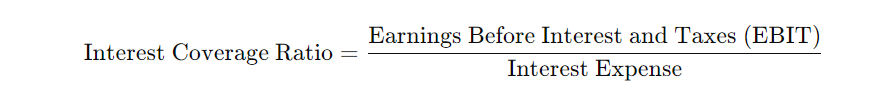

Interest Coverage Ratio

The interest coverage ratio evaluates a company’s ability to cover its interest expenses with its operating income. A high interest coverage ratio suggests that the company is generating enough earnings to comfortably cover its interest payments, reducing the risk of default. The formula is:

For instance, if a company’s EBIT is $500,000 and its interest expense is $100,000, its interest coverage ratio is 5:1. This means that the company can cover its interest payments five times over, signaling strong financial health. A low ratio, however, might indicate that the company struggles to meet its interest obligations, posing a risk of insolvency.

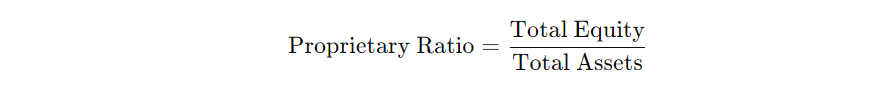

Proprietary Ratio (Equity-to-Asset Ratio)

The proprietary ratio shows the proportion of a company’s assets that are financed by shareholders’ equity. A higher proprietary ratio indicates a stronger financial foundation, as more assets are funded by equity rather than debt. This ratio is important for evaluating a company’s financial independence and resilience. The formula is:

For example, if a company has $1 million in equity and $4 million in assets, the proprietary ratio would be 0.25, or 25%. This means that only a quarter of the company’s assets are financed by equity, which may suggest over-reliance on debt financing.

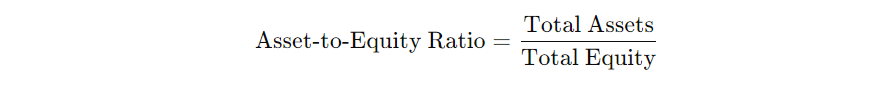

Asset-to-Equity Ratio

This ratio compares a company’s total assets to its equity, showing how effectively the company uses equity to finance its assets. A lower ratio indicates that a company is using its equity efficiently, while a higher ratio can signal greater reliance on debt. The formula is:

For instance, if a company’s assets total $5 million and its equity is $2 million, the asset-to-equity ratio would be 2.5, meaning that for every dollar of equity, the company has $2.50 in assets.

Also read:Importance of Financial Ratios for Investment

Why Are Solvency Ratios Important?

Solvency ratios provide critical insight into a company’s financial resilience. They help stakeholders assess whether a company has enough resources to meet its long-term financial obligations without compromising its operations or depleting shareholder equity.

For creditors, solvency ratios indicate the likelihood of a company defaulting on its loans. A company with strong solvency ratios is more likely to receive favorable terms on loans and other financing options, as it represents lower risk. Investors also rely on solvency ratios to determine the financial health of a business, guiding decisions about long-term investments.

A company that maintains a high solvency ratio is better positioned to weather economic downturns, invest in growth, and navigate financial challenges. On the other hand, a company with weak solvency ratios may face difficulty in securing credit, experience higher borrowing costs, or risk bankruptcy.

How to Improve Solvency

Improving solvency is crucial for any business that seeks to reduce financial risk and enhance its long-term sustainability. Here are several strategies that companies can adopt to improve their solvency:

- Reduce Debt

Reducing reliance on debt can improve solvency by lowering the debt-to-equity and debt ratios. Companies can do this by paying off existing debts or seeking alternative funding methods, such as issuing more equity to investors. Lowering debt not only improves financial ratios but also reduces the company’s interest burden, freeing up cash flow for operations and growth. - Increase Profitability

By increasing operational efficiency and profitability, companies can improve their interest coverage ratio. Higher earnings make it easier to meet interest payments and reduce overall financial risk. Companies can achieve this by optimizing processes, cutting unnecessary expenses, or expanding into new markets to boost revenue. - Restructure Debt

If a company’s debt levels are unsustainable, restructuring the debt can provide relief. Negotiating longer repayment terms or securing lower interest rates can reduce monthly obligations and ease cash flow pressure, giving the company more financial flexibility to meet its long-term liabilities. - Raise Additional Equity

Raising more equity by issuing new shares or attracting additional investors can bolster a company’s financial standing. Increasing equity reduces the company’s debt-to-equity ratio, improving solvency and enhancing the company’s ability to weather future financial challenges. - Improve Cash Flow Management

Effective cash flow management ensures that a company can meet its financial obligations in a timely manner. Implementing strategies to improve accounts receivable collection, reduce unnecessary expenses, and better manage inventory can significantly improve cash flow, contributing to stronger solvency.

Conclusion

Solvency ratios are indispensable tools for evaluating a company’s ability to meet its long-term debt obligations. By monitoring these ratios closely—such as the debt-to-equity ratio, debt ratio, and interest coverage ratio—companies can gauge their financial health and take the necessary steps to improve solvency. Properly managing solvency ensures that a business can not only survive but thrive in the long term, attracting investors and securing better financial terms from lenders.

In an increasingly competitive and volatile business environment, maintaining strong solvency ratios is essential for sustaining operations and positioning the company for future success.

Also read:Net Present Value: Important to Know The Impact of Time on Your Investment Value

References:

- Accurate. (2021). Pengertian Rasio Solvabilitas. https://accurate.id/akuntansi/pengertian-rasio-solvabilitas/

- Investbro. (2023). Rasio Solvabilitas. https://investbro.id/rasio-solvabilitas/

- Investopedia. (2023). Solvency Ratio. https://www.investopedia.com/terms/s/solvencyratio.asp

- Jurnal. (2017). Rasio Solvabilitas dan Cara Penyelesaiannya. https://www.jurnal.id/id/blog/2017-rasio-solvabilitas-dan-cara-penyelesaiannnya/

- OCBC. (2021). Rasio Solvabilitas: Definisi dan Manfaatnya. https://www.ocbc.id/id/article/2021/08/20/rasio-solvabilitas-adalah

- Wallstreetmojo. (2023). Solvency Ratios. https://www.wallstreetmojo.com/solvency-ratios/